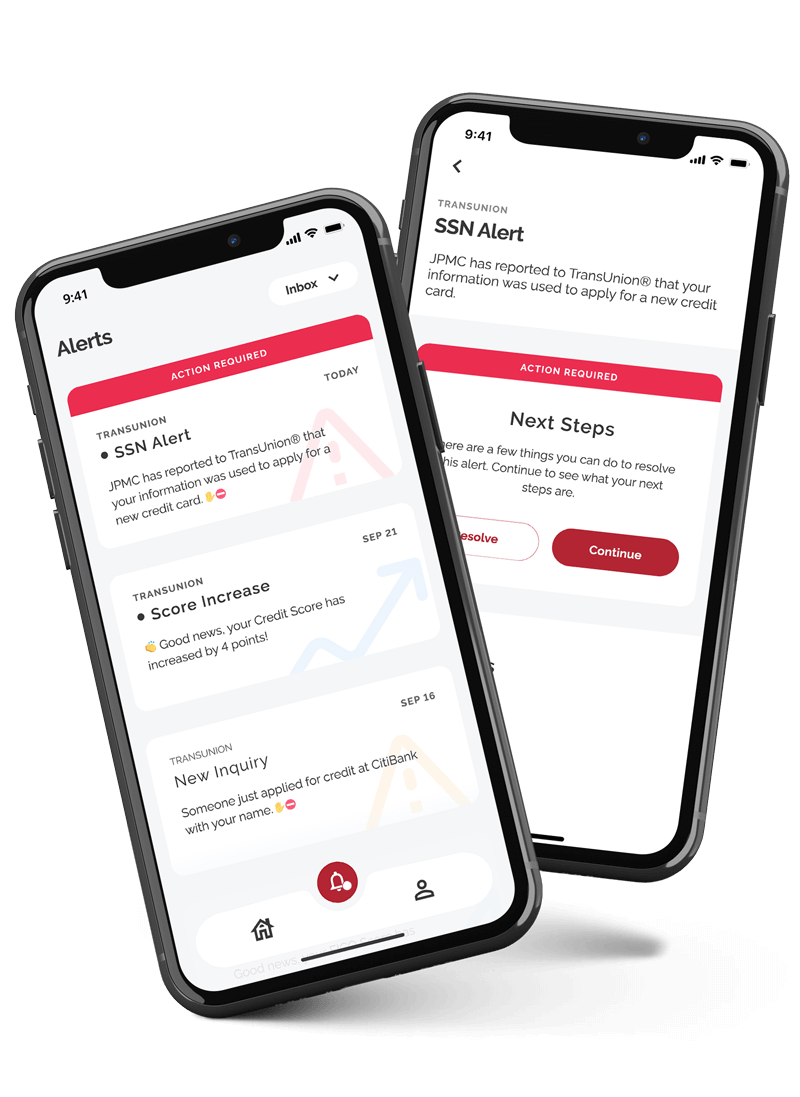

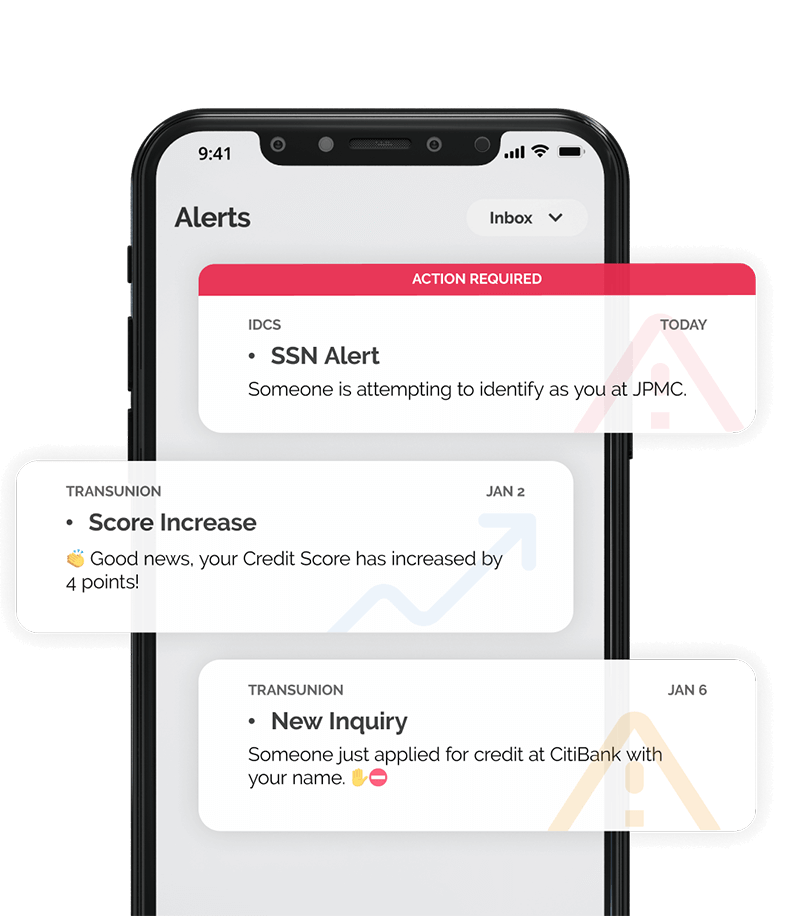

DOWNLOAD THE APP

Get Real-Time Alerts on Your Phone

Start your protection by downloading our mobile app. You receive real-time fraud alerts with the peace of mind knowing your information is protected.

Must be a member to use.

DOWNLOAD THE APP

Get Real-Time Alerts on Your Phone

Start your protection by downloading our mobile app. You receive real-time fraud alerts with the peace of mind knowing your information is protected.

Must be a member to use.

1 in 4 Americans have reported being victims of identity theft ¹

More than 1.5 billion personal records have been exposed in data breaches ²

Cybercriminals are stealing more than $1.5 trillion globally each year³

Choose Your Plan. Get Protected Instantly.

Want More Protection? Add Anti-Virus and VPN.

Monthly Plans

Annual Plans

Save 15%

Our Identity Theft Protection Works So You Don’t Have To.

IdentityIQ identity theft protection plans are dedicated to helping you and your family find peace of mind in all stages of your financial lives.

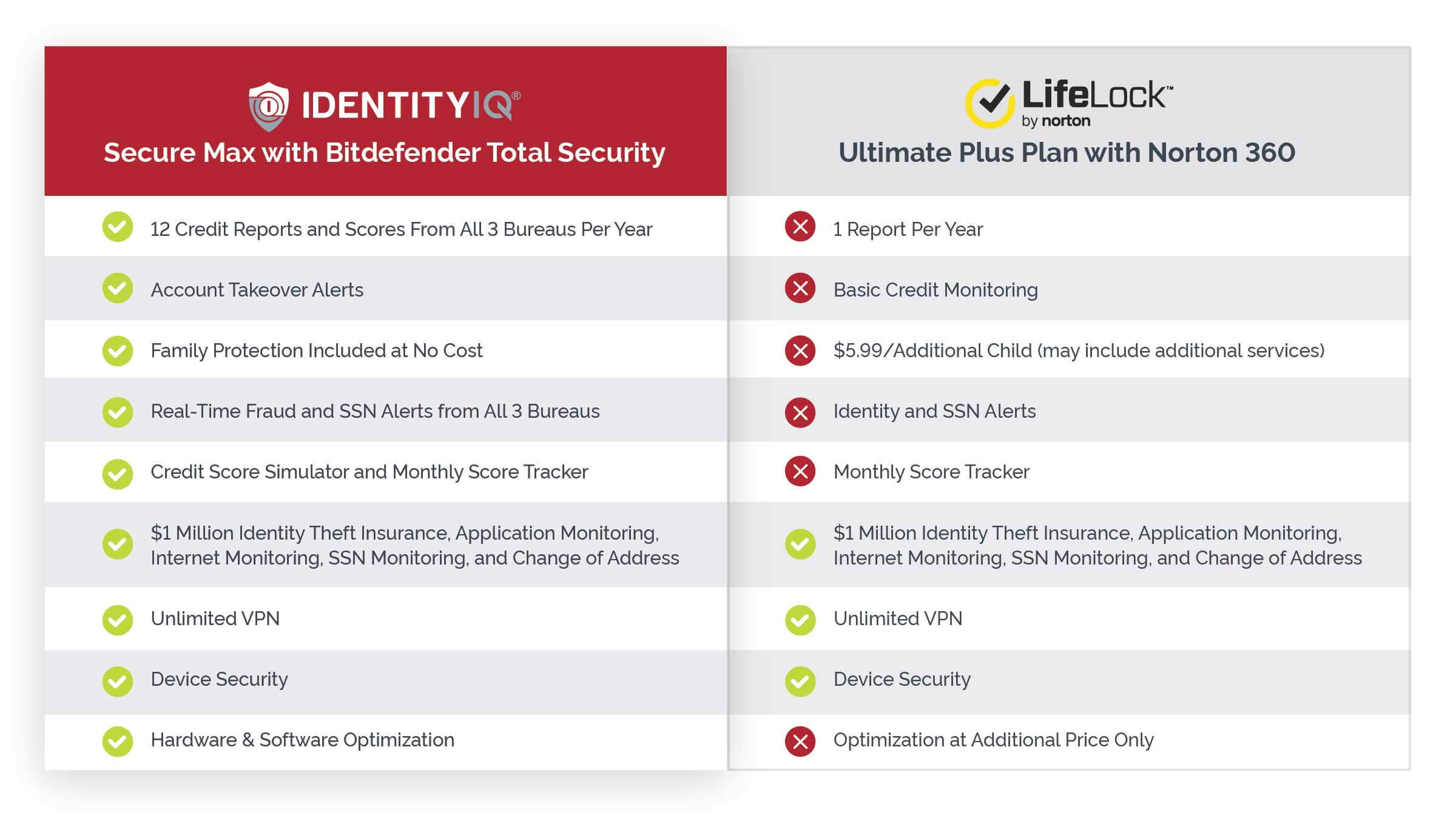

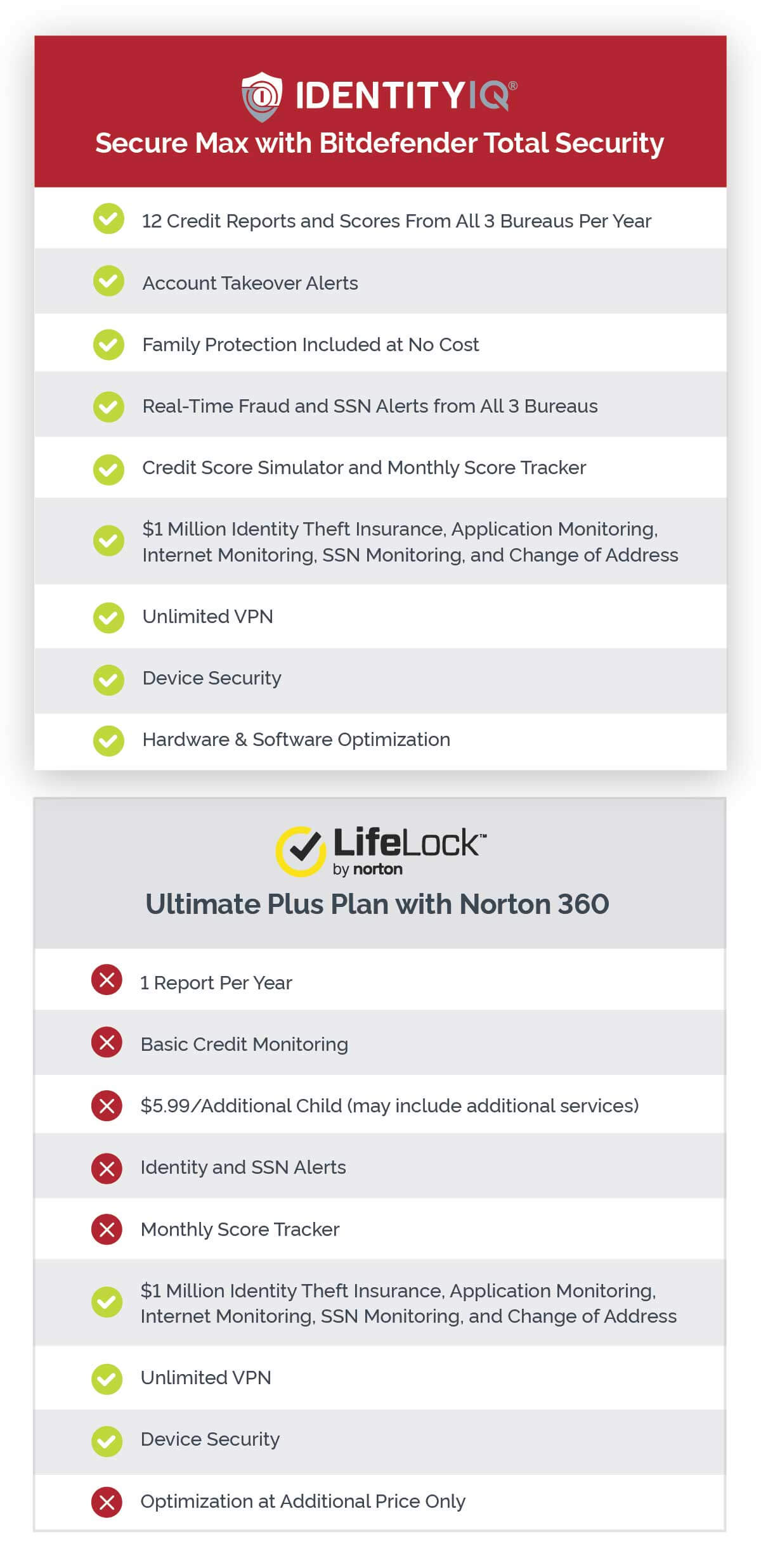

IdentityIQ vs. Lifelock

When comparing similar-priced plans, IdentityIQ benefits go beyond with our tools and features.

All trademarks and tradenames used in price comparisons are acknowledged to be the copyright of their respective owners. IdentityIQ services are not affiliated with the Symantec corporation or any of its brands, including LifeLock. Price comparison and features for LifeLock are shown on this site as presented at www.lifelock.com and may change.

Why Do Thieves Steal Your Identity?

When identity thieves obtain your personal information, they can:

- Open Credit Cards in Your Name

- Make Fraudulent Purchases

- Log into Your Personal Accounts

- Change Your Billing Address

- Obtain a New Driver’s License or Official ID

- Use Your Identity When Questioned by Police

How Do Identity Thieves Steal Your Information?

Comprehensive Protection Plans

Plans

- 3 Bureau Credit Reports & Scores

- Daily 3 Bureau Credit Report Monitoring

- Dark Web & Internet Monitoring

- IQAlerts with Application Monitoring

- SSN Alerts

- Up to $1 Million in Stolen Funds Reimbursement

- Synthetic ID Theft Protection

- Up to $1 Million in Personal Expense Compensation

- Change of Address

- File Sharing Network Searches

- Up to $1 Million in Coverage for Lawyers and Experts

- Lost Wallet Assistance

- Checking Account Report

- Opt-out IQ (Junk Mail/Do Not Call List)

- US-Based ID Restoration Service

- Alerts on Crimes Committed in Your Name

- Score Change Alerts

- Credit Score Tracker

- Credit Scores Simulator

- Family Protection – $25K ID Theft Insurance – ID Fraud Restoration

- Fraud Restoration with LPOA

Secure Plus

- Annual

Secure Pro

- Bi-Annual

Secure Max

- Monthly